Tax Reporting Cloud Services (TRCS)

One of the key components for building an effective, efficient, and transparent corporate tax function is proper access to financial data and processes. Oracle Tax Reporting Cloud solves this dilemma by delivering a tax-owned solution that works with Oracle, Hyperion and non-finance systems.

Simple to Use, Simple to Own

Oracle EPM Cloud makes it easy to own while keeping you connected with finance systems. Wizards make it as easy

as 1-2-3.

Transparency Between Tax and Finance

Leveraging your company's investment in TRCS allows for greater efficiency for tax processes and stronger controls between and tax reporting.

Tax Processes Improvement

Stop using spreadsheets for other key tax processes! Workflow, configurable tax schedules, dashboards, and robust reporting capabilities.

Key Features

Tax Provision

Calculate permanent and temporary differences directly from the source financial data in the general ledgers or from the financial consolidation system, significantly streamlining your tax provision process.

Collect manually-entered data from regional controllers around the world using the complete tax package and workflow engine, ensuring that you have strong internal control over the data collection process, and giving instant insight into the exact status of the tax provision process at all times.

Import tax return details from your tax return software into the application using the industry’s best data assurance tool. Export the tax provision and book trial balance to the tax compliance software at the touch of a button.

Tax Schedules and Dashboards

Completely automate processes that are typically based in spreadsheets using the tax schedule capability. Data collection, calculation, and analysis can all be automated including supporting work papers for tax provision, tax compliance, research and development credit, uncertain tax positions, and any tax data.

Utilize out-of-the-box dashboards with key performance indicators (KPIs) and create custom dashboards for any tax metric.

Provides a framework for constant process improvement for the tax function.

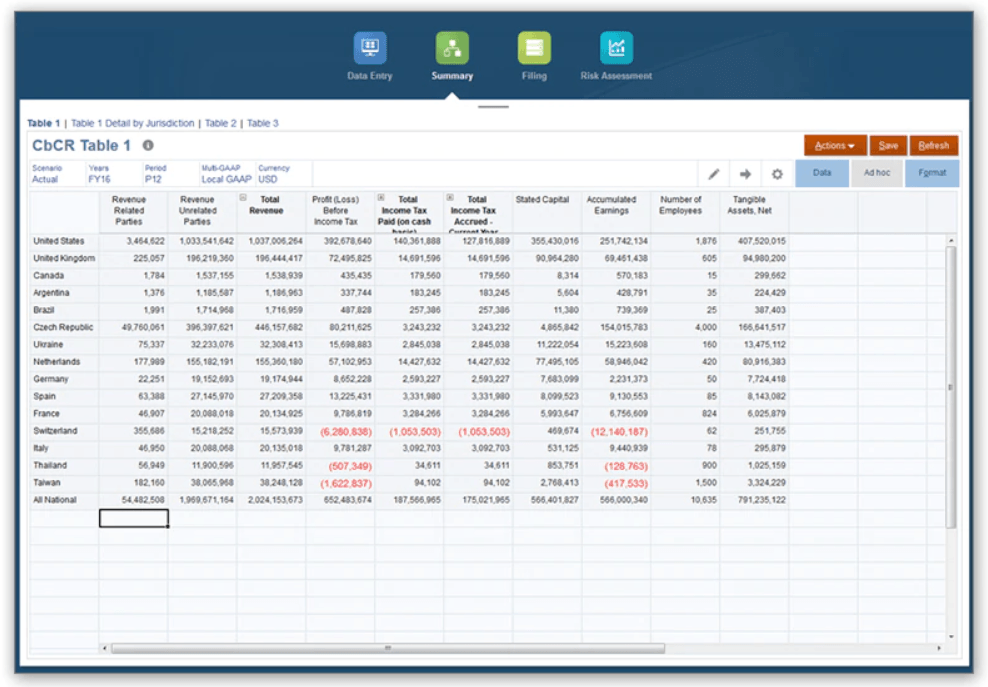

Country-by-Country Reporting Template

Seamlessly populate the country-by-country reporting (CbCR) template with data from Hyperion Financial Management, Oracle Financial Consolidation and Close Cloud, or directly from ERP third-party finance systems, providing complete transparency back to source financial numbers.

Collect information automatically or manually from the out-of-box. The process can be managed by the workflow engine to ensure controls and timely completion of details from users around the world.

Leverage a complete CbCR solution by integrating the tax reporting details with Oracle's narrative management solution Narrative Reporting, allowing corporate tax to collaborate on the local files with users around the world.

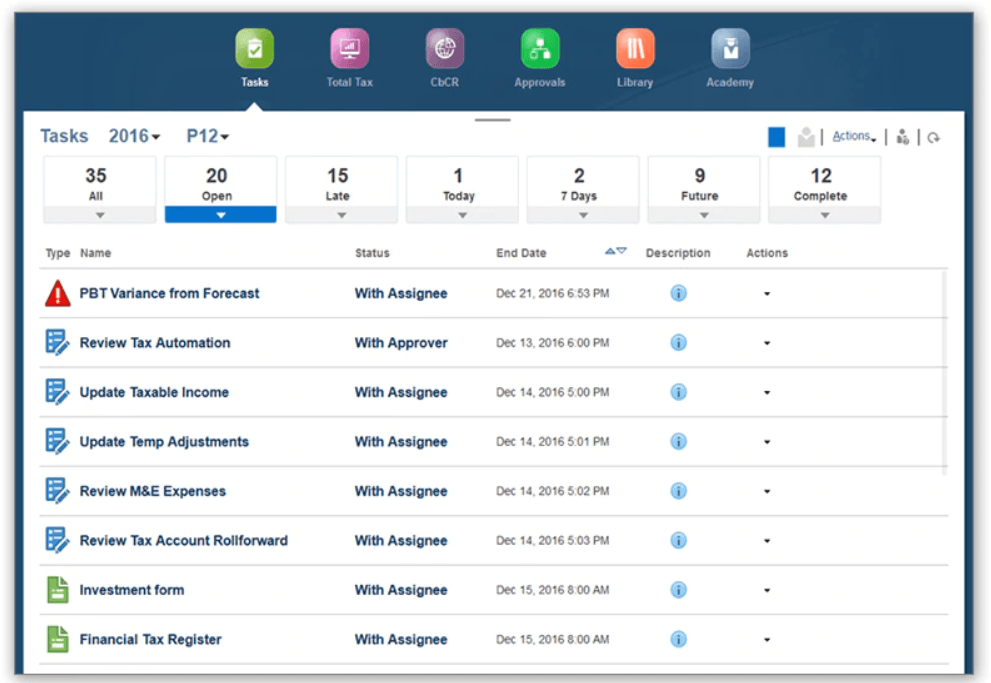

EPM Cloud Collaboration and Workflow

Allow corporate tax to maintain important dates and workflow for key business processes (for example, audit management, tax provision, country-by-country reporting, tax compliance, and more) in a single, easy-to-use system.

Provide enterprise-level collaboration with dynamic, data-driven approval orchestration including third parties in workflows.

Make managing daily tasks easy for end users with a workflow engine that includes integrated tasks with Microsoft Office.

Deploy a fully-secure, cloud-based application with role and data access rights.